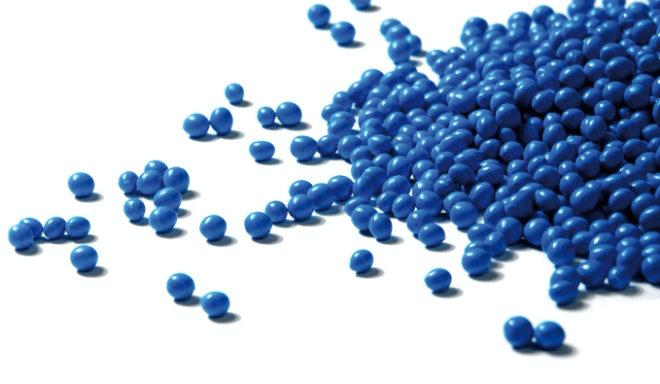

India Thermoplastic Elastomer Market has reached USD1.67 billion by 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 4.86% through 2029. This impressive growth can be attributed to a combination of various factors, including significant technological advancements, a steadily increasing demand from key industries across the board, and highly supportive government policies that have fostered a favorable business environment.

One of the major driving forces behind the thriving TPE market is the burgeoning automotive industry. Reports indicate that the automotive sector has emerged as a substantial contributor to the sustained market for thermoplastic elastomers in India. The versatility of TPEs, with their exceptional properties such as light weight, durability, and flexibility, makes them an ideal choice for manufacturing a wide range of automotive components. Consequently, the demand for TPEs in the automotive sector has witnessed a significant surge.Furthermore, the advent of advanced technologies and the increased focus on research and development activities have resulted in the production of high-quality TPEs that cater to the specific needs of diverse sectors. The applications of TPEs have transcended beyond the automotive industry, finding extensive use in consumer goods, construction, and medical sectors, among others.Undoubtedly, the role of government policies cannot be overlooked in the market expansion of TPEs. The Indian government’s proactive initiatives to boost domestic manufacturing and promote foreign investments have created a highly conducive environment for the growth of the TPE market. However, it is important to acknowledge that the market also faces certain challenges.Fluctuating raw material prices and the environmental concerns associated with the disposal of TPEs are potential hindrances that need to be addressed to ensure sustainable market growth. In conclusion, despite the existing hurdles, the growth prospects for the TPE market in India remain robust. The versatile applications of TPEs, combined with continuous technological advancements and the unwavering support of government policies, are poised to propel the market forward, opening up new avenues of growth and innovation.

Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=17441

Key Market Drivers-India Thermoplastic Elastomer Market

- Growing Demand for Thermoplastic Elastomer in the Automotive Industry Thermoplastic Elastomers (TPEs) are a versatile class of polymers that combine the mechanical properties of elastomers with the processing advantages of thermoplastics. With their unique blend of flexibility, durability, and lightweight characteristics, TPEs have emerged as a favored material in the automotive industry.Automotive manufacturers are increasingly embracing TPEs as they transition away from traditional materials in the production of various components. These components include door seals, handles, knobs, and gaskets. The shift towards TPEs is primarily driven by the pursuit of reducing vehicle weight, improving fuel efficiency, and meeting stringent emission standards.An intriguing trend is the growing demand for TPEs in the manufacturing of rowing components within the automotive industry. This indicates a promising surge in the use of TPEs for producing automotive rowing oars. These oars, crafted from TPEs, exhibit a remarkable combination of lightness and sturdiness, resulting in enhanced performance and durability on the water.While challenges such as fluctuating raw material prices and environmental concerns persist, the future of India’s TPE market continues to hold immense promise. The increasing demand for TPEs in the automotive sector, particularly in the production of rowing components, underscores the potential for sustained growth in the market.

- Growing Demand for Thermoplastic Elastomer in the Medical Industry Thermoplastic elastomers (TPEs) are a versatile class of polymers that possess the desirable characteristics of elastomers combined with the processing advantages of thermoplastics. These materials offer exceptional flexibility, durability, and versatility, making them highly sought-after for the production of various medical components.The medical industry has recognized the numerous benefits of TPEs and is increasingly adopting them for the manufacturing of medical devices and equipment. From tubes and catheters to gloves and seals, TPEs have proven to be an ideal choice due to their superior performance attributes. These include biocompatibility, sterilizability, and resistance to wear and tear, ensuring the safety and longevity of medical products.The growth of the TPE market in the medical sector is further supported by government initiatives aimed at boosting domestic manufacturing and encouraging foreign investments. These favorable policies create an environment conducive to the expansion of the TPE industry. Additionally, continuous advancements in technology and increased research and development activities contribute to the production of high-quality TPEs, meeting the evolving needs of the medical sector.In conclusion, the rising demand for TPEs in the medical industry, driven by the requirement for high-performance medical components, signifies a promising future for India’s TPE market. As the medical industry continues to innovate and expand, the demand for TPEs is expected to follow suit, propelling the market forward and presenting opportunities for further growth.

Key Market Players-India Thermoplastic Elastomer Market

- Kraiburg TPE Pvt. Ltd.Basell Polyolefins India Pvt. Ltd.Zylog Plastalloys Pvt. Ltd.Exxonmobil Company India Pvt. Ltd.DuPont India Pvt. Ltd.BASF India Ltd.

Key Market Challenges-India Thermoplastic Elastomer Market

- Volatility in Prices of Raw Materials Thermoplastic elastomers (TPEs) are a versatile class of polymers that offer the combined advantages of elastomers and thermoplastics. These materials exhibit excellent elasticity and flexibility, similar to traditional elastomers, while also benefiting from the easy processing and recyclability of thermoplastics.The production of TPEs involves a careful selection of raw materials, including popular choices such as styrene, polypropylene, and ethylene-propylene-diene monomer (EPDM). These raw materials contribute to the unique properties and performance characteristics of TPEs. However, their prices are subject to fluctuations influenced by several factors.One of the primary factors impacting the prices of these raw materials is the volatility in crude oil prices. As crude oil serves as a feedstock for many petrochemical products, including styrene and polypropylene, any changes in its market value can directly affect the cost of these materials. Additionally, supply-demand dynamics, geopolitical issues, and exchange rates also contribute to the price volatility of TPE raw materials.For the TPE market in India, the volatility in raw material prices poses a significant challenge. Manufacturers in the region face the daunting task of navigating these price fluctuations, which can disrupt their planning and budgeting processes. Unpredictable production costs can affect the overall business strategy and profitability of TPE manufacturers, requiring them to adopt proactive measures to maintain consistent pricing and profit margins.Furthermore, the uncertainty in raw material prices can impact the competitiveness of the TPE market. If manufacturers are forced to pass on the increased costs to consumers, it may lead to reduced demand, especially if cheaper alternatives are available. Balancing cost considerations with market demand and consumer preferences becomes crucial for sustaining growth and market share in the TPE industry.In conclusion, while the TPE market continues to exhibit strong growth potential, the volatility in raw material prices presents a significant challenge. Addressing this issue calls for strategic planning, innovative solutions, and potentially even policy interventions to ensure the sustainable growth of the market. By enhancing stability and predictability in raw material prices, the TPE industry can thrive and contribute to various sectors, including automotive, consumer goods, and medical applications.

Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=17441

Key Market Trends-India Thermoplastic Elastomer Market

- Adoption of Overmolding and 2K Injection Molding Overmolding, a two-step injection molding process, involves molding TPE (thermoplastic elastomer) onto a previously molded part, usually made from a different material. This technique has gained significant popularity in various industries due to its ability to enhance product quality and performance. By improving grip, reducing noise and vibration, and providing electrical insulation, over-molding has become a favored method for creating functional and aesthetically appealing components.In the automotive sector, over molding technology is being widely used to create components that combine the durability of engineering thermoplastics with the flexibility of elastomers. This innovative approach results in parts that not only exhibit enhanced performance but also possess improved aesthetics, which in turn increases consumer appeal. The ability to seamlessly integrate different materials through over-molding has revolutionized the design and functionality of automotive components.Another advanced technique in injection molding is 2K injection molding, also known as multi-component or two-shot molding. This method involves injecting two different materials into the same mold to produce a single component. It offers numerous advantages, particularly when using recycled polypropylene (rPP) and ethylene propylene diene monomer (EPDM), which are common raw materials for TPEs. By utilizing 2K injection molding, manufacturers can streamline the production process, reduce waste, and achieve complex shapes that would be difficult to produce using conventional methods.Furthermore, 2K injection molding provides manufacturers with greater design flexibility, enabling them to create components with different colors, textures, and levels of rigidity in a single process. This capability not only enhances the visual appeal of the final product but also opens up new possibilities for customization and differentiation. You may also read:India Adhesives Market | [2029] Exploring Growth, Potential and Future, TrendsIndia Specialty Chemicals Market [2029]: A Deep Dive into the Latest Market Trends, Market Segmentation[2029] India Ethanol Market Future, Outlook, Outlook, Segments Table of Content-India Thermoplastic Elastomer Market

- Product Overview 1.1. Market Definition1.2. Scope of the Market1.2.1. Markets Covered1.2.2. Years Considered for Study1.2.3. Key Market Segmentations

- Research Methodology

2.1. Objective of the Study2.2. Baseline Methodology2.3. Key Industry Partners2.4. Major Association and Secondary Applications2.5. Forecasting Methodology2.6. Data Triangulation & Validation2.7. Assumptions and Limitations

- Executive Summary

3.1. Overview of the Market3.2. Overview of Key Market Segmentations3.3. Overview of Key Market Players3.4. Overview of Key Regions/Countries3.5. Overview of Market Drivers, Challenges, Trends

- India Thermoplastic Elastomers Market Outlook

4.1. Market Size & Forecast4.1.1. By Value 4.2. Market Share & Forecast4.2.1. By Type (Styrenic Block Copolymers, Thermoplastic Olefins, Thermoplastic Polyurethanes, Others)4.2.2. By End User (Automotive, Consumer Durables, Medical, Others)4.2.3. By Region4.2.4. By Company (2023)4.3. Market Map4.3.1. By Type4.3.2. By End User4.3.3. By Region

- North India Thermoplastic Elastomers Market Outlook

5.1. Market Size & Forecast 5.1.1.By Value5.2. Market Share & Forecast5.2.1. By Type5.2.2. By End User5.2.3. By State (Top 3 States)

- South India Thermoplastic Elastomers Market Outlook

6.1. Market Size & Forecast 6.1.1.By Value6.2. Market Share & Forecast6.2.1. By Type6.2.2. By End User6.2.3. By State (Top 3 States)

- West India Thermoplastic Elastomers Market Outlook

7.1. Market Size & Forecast 7.1.1.By Value7.2. Market Share & Forecast7.2.1. By Type7.2.2. By End User7.2.3. By State (Top 3 States)