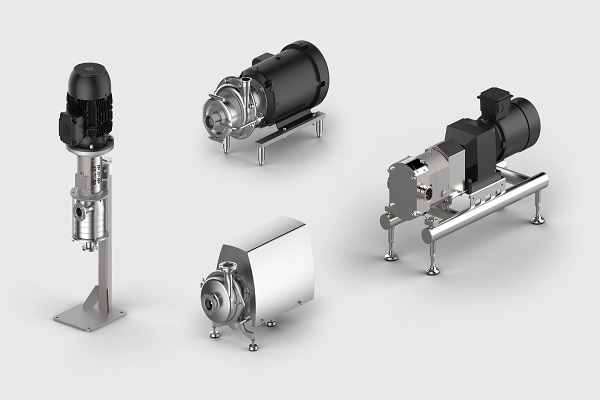

The Global Sanitary Pumps and Valves market is expected to grow at a healthy CAGR during the forecast period. Sanitary pumps and valves are essential components used in various industries, particularly in the food, beverage, pharmaceutical, and biotechnology sectors. These specialized pumps and valves are designed to meet strict sanitary standards and maintain the hygiene and purity of the fluids being handled. Sanitary pumps are used to transfer fluids, such as liquids, viscous materials, or even semi-solids, in a hygienic manner.

They are constructed with materials that are compatible with the specific industry requirements and are designed to minimize the risk of contamination. Centrifugal pumps use centrifugal force to move fluids. They are widely used for their efficiency and gentle handling of delicate products. Positive displacement pumps create a fixed volume of fluid for each cycle. Examples include rotary lobe pumps, peristaltic pumps, and diaphragm pumps. Positive displacement pumps are suitable for viscous or shear-sensitive materials. Air-operated diaphragm pumps use compressed air to move a flexible diaphragm, resulting in fluid transfer. They are often used in applications where electricity is not readily available or where the risk of sparks is a concern.Sanitary valves control the flow of fluids in a sanitary process system. They are designed to be easily cleanable and to prevent product build-up or contamination. Ball valves have a ball with a hole in the middle that rotates to control the flow. They provide good sealing capabilities and are widely used in sanitary applications. Butterfly valves consist of a disc mounted on a rotating shaft. When the disc is turned, it either allows or restricts the flow of the fluid. They are lightweight, compact, and offer quick operation. Diaphragm valves use a flexible diaphragm to regulate the flow. They provide excellent sealing and are commonly used in applications where cleanliness and sterility are critical. Check valves allow fluid to flow in only one direction, preventing backflow and contamination. They are essential in maintaining the integrity of the process and preventing cross-contamination.In both sanitary pumps and valves, the materials used for construction are typically stainless steel or other corrosion-resistant alloys. These materials are easy to clean, withstand harsh cleaning agents, and are resistant to bacterial growth. Overall, sanitary pumps and valves play a crucial role in ensuring hygienic and contaminant-free fluid handling processes in industries that require strict sanitary standards. Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=17152 Government mandates and regulations regarding maintaining hygiene standards in process industries are fueling the growth of sanitary pumps and valves market across the globeGovernment mandates and regulations pertaining to hygiene and safety standards have a significant impact on the growth of the sanitary pumps and valves market worldwide. These regulations aim to ensure the integrity and safety of processes in industries such as food and beverage, pharmaceuticals, and biotechnology. Governments worldwide have implemented stringent regulations to maintain food safety and prevent contamination. Sanitary pumps and valves are essential components in food processing, where maintaining hygiene is critical. Regulations such as Hazard Analysis and Critical Control Points (HACCP) and Good Manufacturing Practices (GMP) require the use of sanitary equipment to ensure safe food production. This drives the demand for sanitary pumps and valves in the food industry.The pharmaceutical and biotechnology industries are highly regulated due to the critical nature of the products involved. Authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce strict guidelines for maintaining sanitary conditions during manufacturing processes. Sanitary pumps and valves are integral to meeting these standards, ensuring the purity and safety of pharmaceutical and biotech products.Governments worldwide have regulations in place to ensure the safe treatment and disposal of wastewater. Sanitary pumps and valves play a crucial role in water and wastewater treatment processes, including pumping, mixing, and controlling the flow. Compliance with environmental regulations, such as those related to water quality and pollution control, drives the adoption of sanitary pumps and valves in this sector.Governments focus on the health and safety of workers in process industries. Sanitary pumps and valves are designed to minimize the risk of accidents, provide ease of cleaning, and prevent exposure to hazardous materials. Compliance with occupational health and safety regulations drives the demand for sanitary equipment in industries where employee safety is a priority.As a result of these regulations, industries are increasingly investing in sanitary pumps and valves to meet the required standards. This drives the market growth of sanitary pumps and valves globally. Manufacturers in this industry are continually innovating to develop products that comply with regulatory standards while delivering efficient and reliable performance.Increasing focus on automation for higher efficiency and safety to drive the demand for sanitary pumps and valves marketThe increasing focus on automation for higher efficiency and safety is a significant driver for the growth of the sanitary pumps and valves market. Automation offers numerous advantages in process industries, including improved productivity, enhanced control, and reduced human error. Automation allows for precise control and monitoring of fluid handling processes, enabling real-time adjustments to ensure optimal flow rates, pressure, and temperature. Sanitary pumps and valves integrated with automation systems can automatically regulate process parameters, leading to improved efficiency and performance. Automation technology enables remote monitoring and control of sanitary pumps and valves. Operators can monitor the performance, status, and condition of these components from a centralized control room or even through mobile devices. This capability improves operational efficiency and reduces the need for manual intervention, resulting in cost savings and enhanced safety.Automated systems can incorporate sensors and diagnostics to detect faults or abnormalities in sanitary pumps and valves. By continuously monitoring parameters such as vibration, temperature, and pressure, potential issues can be identified early on. This proactive approach allows for preventive maintenance and minimizes the risk of unexpected breakdowns, reducing downtime and improving overall equipment reliability.Automation facilitates the seamless integration of sanitary pumps and valves with overall process control systems. This integration enables streamlined communication, data exchange, and coordination between different components of the system. It allows for efficient coordination of multiple pumps and valves, optimizing the overall process performance and ensuring consistent product quality.Automation technology can enhance safety in process industries by automating critical operations and minimizing human intervention. This reduces the risk of accidents or errors. Automated systems can incorporate safety features such as emergency shutdowns, alarms, and interlocks to ensure safe operation of sanitary pumps and valves.The demand for automated sanitary pumps and valves is driven by the pursuit of higher efficiency, improved productivity, and enhanced safety in process industries. Manufacturers in the market are developing advanced automation solutions, integrating intelligent features, and offering user-friendly interfaces to meet the growing demand for automated systems.Growing competition from local players and gray market players hinders the growth for the sanitary pumps and valves marketGrowing competition from local players and gray market players can pose challenges and potentially hinder the growth for the sanitary pumps and valves market. Local players and gray market sellers often compete on the basis of lower prices. This can create pricing pressure for established manufacturers in the market. To remain competitive, manufacturers may need to adjust their pricing strategies, which could affect their profit margins and overall market growth. Gray market players may offer products at lower prices, but their products may not meet the required quality standards and certifications. Customers may be attracted to lower prices initially, but if they experience issues with product performance or safety, it can damage the reputation of the entire market. Quality concerns associated with gray market products can hinder overall market growth by eroding customer trust.Local players often have a strong presence in their respective regions and a better understanding of local distribution channels. This can make it challenging for established manufacturers to penetrate or expand their market share in specific geographic areas. Distribution challenges can hinder market growth by limiting the reach of sanitary pumps and valves to potential customers. Local players and gray market sellers may have limited resources and capabilities for research and development. This can result in a lack of innovation and slower product development compared to established manufacturers. A stagnant market with limited innovation can hinder overall market growth and limit the introduction of new and advanced products.

Market Segmentation

Based on Valve Type, the market is segmented into Single Seat Valve, Double Seat Valve, Butterfly Valve, Diaphragm Valve, Control Valve, and Others. Based on Pump Type, the market is further bifurcated into Centrifugal, Positive Displacement. Based on Material Type, the market is further split into Stainless Steel, Bronze, and Copper. Based on Hygiene Class, the market is divided into Standard, Aseptic, and Ultraclean. Based on Pump Power Source, the market is further split into Self-Priming, and Non-Self-Priming. Based on End-User Industry, the market is categorized into Processed Food, Dairy, alcoholic Beverage, Non Alcoholic Beverage, Pharmaceutical, and Others.

Company Profiles

Alfa Laval AB, Ampco Pumps Company, Dixon Valve & Coupling Company, LLC, Dover Corporation, GEA Group Aktiengesellschatt, Holland Applied Technologies, Inc., IDEX Corporation, KSB SE & Co. KGaA, SPX Corporation, Tapflo Group, are among the major players that are driving the growth of the global Sanitary Pumps and Valves market.

AttributeDetailsBase Year2022Historical Years2018 – 2021Estimated Year2023Forecast Period2024 – 2028Quantitative UnitsRevenue in USD Billion and CAGR for 2018-2022 and 2023E-2028FReport CoverageRevenue forecast, company share, competitive landscape, growth factors, and trendsSegments CoveredBy Valve TypeBy Pump TypeBy Material TypeBy Hygiene ClassBy Pump Power SourceBy End-User IndustryBy RegionRegional ScopeAsia-Pacific, North America, Europe, Middle East & Africa, and South AmericaCountry ScopeChina, Japan, India, Australia, South Korea, United States, Canada, Mexico, United Kingdom, Germany, France, Spain, Italy, Israel, Turkey, Saudi Arabia, UAE, South Africa, Brazil, Argentina, ColombiaKey Companies ProfiledAlfa Laval AB, Ampco Pumps Company, Dixon Valve & Coupling Company, LLC, Dover Corporation, GEA Group Aktiengesellschatt, Holland Applied Technologies, Inc., IDEX Corporation, KSB SE & Co. KGaA, SPX Corporation, Tapflo GroupCustomization Scope10% free report customization with purchase. Addition or alteration to country, regional & segment scope.Pricing and Purchase OptionsAvail of customized purchase options to meet your exact research needs. Explore purchase optionsDelivery FormatPDF and Excel through Email (We can also provide the editable version of the report in PPT/pdf format on special request)

Report Scope:

In this report, the global sanitary pumps and valves market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Single Seat ValveDouble Seat ValveButterfly ValveDiaphragm ValveControl ValveOthers

- CentrifugalPositive Displacement

- Stainless SteelBronzeCopper

- StandardAsepticUltraclean

- Self-PrimingNon-Self-Priming

- Processed FoodDairyAlcoholic BeverageNon Alcoholic BeveragePharmaceuticalOthers

- North America

- United StatesCanadaMexico

- United KingdomGermanyFranceSpainItaly

- ChinaJapanIndiaAustraliaSouth Korea

- IsraelTurkeySaudi ArabiaUAE

- BrazilArgentinaColombia

- Research Methodology

2.1. Objective of the Study2.2. Baseline Methodology2.3. Key Industry Partners2.4. Major Association and Secondary Sources2.5. Forecasting Methodology2.6. Data Triangulation & Validation2.7. Assumptions and Limitations

- Executive SummaryVoice of CustomerGlobal Sanitary Pumps and Valves Market Outlook

5.1. Market Size & Forecast5.1.1. By Value5.2. Market Share & Forecast5.2.1. By Valve Type (Single Seat Valve, Double Seat Valve, Butterfly Valve, Diaphragm Valve, Control Valve, and Others)5.2.2. By Pump Type (Centrifugal, Positive Displacement)5.2.3. By Material Type (Stainless Steel, Bronze, and Copper)5.2.4. By Hygiene Class (Standard, Aseptic, and Ultraclean)5.2.5. By Pump Power Source (Self-Priming, and Non-Self-Priming)5.2.6. By End-User Industry (Processed Food, Dairy, alcoholic Beverage, Non Alcoholic Beverage, Pharmaceutical, and Others)5.3. By Company (2022)5.4. Market Map5.4.1. By Valve Type5.4.2. By Pump Type5.4.3. By Material Type5.4.4. By Hygiene Class5.4.5. By Pump Power Source5.4.6. By End-User Industry5.4.7. By Region

- North America Sanitary Pumps and Valves Market Outlook

6.1. Market Size & Forecast6.1.1. By Value6.2. Market Share & Forecast6.2.1. By Valve Type6.2.2. By Pump Type6.2.3. By Material Type6.2.4. By Hygiene Class6.2.5. By Pump Power Source6.2.6. By End-User Industry6.3. North America: Country Analysis6.3.1. United States Sanitary Pumps and Valves Market Outlook6.3.1.1. Market Size & Forecast6.3.1.1.1. By Value 6.3.1.2. Market Share & Forecast6.3.1.2.1. By Valve Type6.3.1.2.2. By Pump Type6.3.1.2.3. By Material Type6.3.1.2.4. By Hygiene Class6.3.1.2.5. By Pump Power Source6.3.1.2.6. By End-User Industry6.3.2. Canada Sanitary Pumps and Valves Market Outlook6.3.2.1. Market Size & Forecast6.3.2.1.1. By Value 6.3.2.2. Market Share & Forecast6.3.2.2.1. By Valve Type6.3.2.2.2. By Pump Type6.3.2.2.3. By Material Type6.3.2.2.4. By Hygiene Class6.3.2.2.5. By Pump Power Source6.3.2.2.6. By End-User Industry6.3.3. Mexico Sanitary Pumps and Valves Market Outlook6.3.3.1. Market Size & Forecast6.3.3.1.1. By Value 6.3.3.2. Market Share & Forecast6.3.3.2.1. By Valve Type6.3.3.2.2. By Pump Type6.3.3.2.3. By Material Type6.3.3.2.4. By Hygiene Class6.3.3.2.5. By Pump Power Source6.3.3.2.6. By End-User Industry

- Asia-Pacific Sanitary Pumps and Valves Market Outlook

7.1. Market Size & Forecast7.1.1. By Value7.2. Market Share & Forecast7.2.1. By Valve Type7.2.2. By Pump Type7.2.3. By Material Type7.2.4. By Hygiene Class7.2.5. By Pump Power Source7.2.6. By End-User Industry7.2.7. By Country7.3. Asia-Pacific: Country Analysis7.3.1. China Sanitary Pumps and Valves Market Outlook7.3.1.1. Market Size & Forecast7.3.1.1.1. By Value 7.3.1.2. Market Share & Forecast7.3.1.2.1. By Valve Type7.3.1.2.2. By Pump Type7.3.1.2.3. By Material Type7.3.1.2.4. By Hygiene Class7.3.1.2.5. By Pump Power Source7.3.1.2.6. By End-User Industry7.3.2. Japan Sanitary Pumps and Valves Market Outlook7.3.2.1. Market Size & Forecast7.3.2.1.1. By Value 7.3.2.2. Market Share & Forecast7.3.2.2.1. By Valve Type7.3.2.2.2. By Pump Type7.3.2.2.3. By Material Type7.3.2.2.4. By Hygiene Class7.3.2.2.5. By Pump Power Source7.3.2.2.6. By End-User Industry7.3.3. South Korea Sanitary Pumps and Valves Market Outlook7.3.3.1. Market Size & Forecast7.3.3.1.1. By Value 7.3.3.2. Market Share & Forecast7.3.3.2.1. By Valve Type7.3.3.2.2. By Pump Type7.3.3.2.3. By Material Type7.3.3.2.4. By Hygiene Class7.3.3.2.5. By Pump Power Source7.3.3.2.6. By End-User Industry7.3.4. India Sanitary Pumps and Valves Market Outlook7.3.4.1. Market Size & Forecast7.3.4.1.1. By Value 7.3.4.2. Market Share & Forecast7.3.4.2.1. By Valve Type7.3.4.2.2. By Pump Type7.3.4.2.3. By Material Type7.3.4.2.4. By Hygiene Class7.3.4.2.5. By Pump Power Source7.3.4.2.6. By End-User Industry7.3.5. Australia Sanitary Pumps and Valves Market Outlook7.3.5.1. Market Size & Forecast7.3.5.1.1. By Value 7.3.5.2. Market Share & Forecast7.3.5.2.1. By Valve Type7.3.5.2.2. By Pump Type7.3.5.2.3. By Material Type7.3.5.2.4. By Hygiene Class7.3.5.2.5. By Pump Power Source7.3.5.2.6. By End-User Industry