Germany Fiberglass Market was valued at USD 499.97 million in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 5.25% through 2028. Germany has been actively investing in infrastructure development, including transportation networks, energy projects, and urban renewal. The government’s commitment to improving the country’s infrastructure is driving the demand for construction materials, including fiberglass composites used in bridges, tunnels, and buildings.

Key Market Drivers

Sustainability and Environmental Concerns

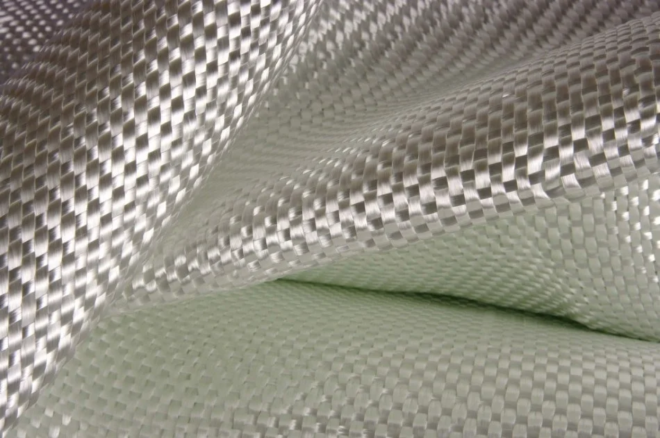

The Germany fiberglass market is experiencing a significant driver in the form of sustainability and heightened environmental concerns. As global awareness of the impact of traditional construction materials on the environment grows, there is an increasing demand for sustainable and eco-friendly alternatives. Fiberglass is emerging as a viable solution due to its low environmental footprint and recyclability.

One key factor driving this trend is the need to reduce carbon emissions. Fiberglass production, when compared to traditional materials like steel or concrete, consumes less energy and emits fewer greenhouse gases. As Germany aims to meet its ambitious climate targets and transition towards a more sustainable future, fiberglass stands out as a material that aligns with these goals.

Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=2988

Another aspect of sustainability is the longevity and durability of fiberglass products. In construction and infrastructure, fiberglass components have a longer lifespan, reducing the need for frequent replacements and repairs. This results in less waste and further minimizes the environmental impact of fiberglass usage.

Moreover, fiberglass’s versatility in design and application is contributing to its growth in the market. It can be molded into various shapes and used in a wide range of industries, from automotive to aerospace, making it a versatile and sustainable choice across diverse sectors.

Technological Advancements and Innovation

Technological advancements are a significant driver of the German fiberglass market. These innovations are improving the quality, performance, and applications of fiberglass products, making them more attractive to various industries.

One critical technological advancement is the development of advanced composite materials. These composites combine fiberglass with other materials to enhance specific properties, such as strength, conductivity, or fire resistance. For instance, the incorporation of carbon fibers into fiberglass composites has created stronger and lighter materials suitable for aerospace and automotive industries. This diversification of fiberglass materials has expanded its reach and application.

The manufacturing processes for fiberglass have also evolved, leading to increased efficiency and cost-effectiveness. Automation and robotics in production have not only reduced labor costs but also improved the consistency and quality of fiberglass products. This has made fiberglass more competitive with traditional materials in terms of cost.

Furthermore, advancements in nanotechnology have allowed for the development of nanofibers, which are ultra-thin fibers that can be incorporated into traditional fiberglass materials. These nanofibers enhance properties like strength, electrical conductivity, and thermal resistance, opening up new possibilities in industries like electronics and energy storage.

Infrastructure Development and Urbanization

Germany’s ongoing infrastructure development and urbanization are driving the fiberglass market as the demand for durable, lightweight, and corrosion-resistant materials increases. The construction of new buildings, bridges, and transportation systems requires materials that can withstand the challenges of a modern, densely populated environment.

In urban settings, fiberglass-reinforced concrete is increasingly being used due to its high strength, durability, and resistance to corrosion from pollution and moisture. This extends the lifespan of infrastructure and reduces maintenance costs, making it a cost-effective choice for both public and private projects.

The transportation sector is also benefiting from fiberglass’s properties. Lightweight, high-strength fiberglass components are being utilized in the automotive and aerospace industries to reduce fuel consumption and enhance performance. As Germany’s focus on sustainable transportation and reducing emissions grows, the demand for these innovative materials is on the rise.

Moreover, fiberglass is a versatile material for the construction of specialized structures, such as wind turbine blades, which are integral to Germany’s commitment to renewable energy production. The country’s transition to clean energy sources is fueling the demand for fiberglass in the renewable energy sector, further boosting the market.

In conclusion, the Germany fiberglass market is being driven by sustainability and environmental concerns, technological advancements, and the ongoing infrastructure development and urbanization. These drivers are shaping the demand for fiberglass across a broad spectrum of industries, making it a key player in the country’s economic and environmental future.

Key Market Challenges

Competitive Global Market

One of the primary challenges facing the Germany fiberglass market is the fierce competition in the global arena. The fiberglass industry is not limited to national boundaries, and German manufacturers face intense competition from both domestic and international players. This global competition puts pressure on pricing, quality, and innovation.

Chinese fiberglass manufacturers, in particular, have been a formidable force in the market. They benefit from lower labor and production costs, allowing them to offer more competitive prices. German companies must contend with this price pressure while maintaining high-quality standards and environmental regulations. Competing with low-cost alternatives can be a significant challenge, especially in price-sensitive industries like construction and automotive.

Additionally, the global nature of the market means that Germany’s fiberglass exports are also influenced by trade policies and tariffs, which can disrupt the supply chain and add further uncertainty to the industry.

Raw Material Supply and Cost Fluctuations

The Germany fiberglass market heavily relies on the supply of raw materials, particularly glass fiber and resins. The prices and availability of these materials are subject to fluctuations, which can pose challenges for manufacturers in the market.

The cost of raw materials can be affected by various factors, including international trade dynamics, changes in demand, and the availability of key components. Sudden price increases can significantly impact production costs, affecting the overall competitiveness of German fiberglass products.

Moreover, securing a stable supply of high-quality raw materials is essential to maintain the quality and consistency of fiberglass products. Any disruption in the supply chain can lead to production delays, increased costs, and potential quality issues, all of which can harm a company’s reputation and market position.

Environmental regulations and sustainability initiatives can also impact the choice of raw materials. As the industry focuses on eco-friendly alternatives, the availability and pricing of sustainable materials can pose additional challenges for fiberglass manufacturers.

Glass Type Insights

The Direct & Assembled Roving segment emerged as the dominating segment in 2022. Direct Roving consists of continuous fibers without any twisting. It is typically used in applications where strength, compatibility with specific resins, and minimal fiber distortion are essential. Direct Roving is designed to provide uniform fiber distribution and mechanical properties.

Direct Roving is commonly used as reinforcement in composite materials, including fiberglass-reinforced plastics (FRP) and composites used in construction, automotive, and aerospace industries. It is used in the manufacture of pipes and tanks to improve structural integrity and corrosion resistance.

Assembled Roving consists of multiple strands of glass fibers twisted together to form a single bundle. The twisting enhances handling, processability, and compatibility with various resin systems.

Assembled Roving is used in the production of thermoplastic composites, such as polypropylene (PP) or polyethylene (PE) reinforced with fiberglass for lightweight and durable components in automotive and construction.

The Direct and Assembled Roving segment in the Germany fiberglass market plays a crucial role in enhancing the properties and versatility of fiberglass materials. These specialized rovings are designed to meet the specific requirements of different applications, providing the market with adaptability and performance.

The demand for Direct Roving and Assembled Roving continues to grow in the composite manufacturing sector. These rovings are essential for producing lightweight and strong composite materials used in industries such as automotive, aerospace, construction, and renewable energy.

Application Insights

The Automobile Roving segment is projected to experience rapid growth during the forecast period. One of the primary driving factors for the use of fiberglass materials in the automotive industry is the need for lightweighting. As Germany continue to implement stringent emissions regulations and fuel efficiency standards, automakers are increasingly turning to lightweight materials to reduce vehicle weight and improve fuel efficiency.

Fiberglass composites are used in the manufacturing of body panels, such as hoods, fenders, and doors, to reduce overall vehicle weight. This contributes to better fuel economy and lower emissions.

Fiberglass is used in the construction of structural components like chassis and roll cages, enhancing vehicle safety by reducing the risk of deformation during a collision.

Fiberglass is used in the construction of battery enclosures and support structures for electric and hybrid vehicles, contributing to the overall efficiency of these vehicles. In high-performance and sports cars, fiberglass materials play a pivotal role in enhancing performance and customization. These materials offer a balance of strength, weight, and moldability, allowing for innovative designs and improved performance.

Fiberglass is used to create aerodynamic components like spoilers, diffusers, and body kits, which optimize airflow and improve a vehicle’s handling and performance.

In conclusion, the automotive segment of the Germany fiberglass market is undergoing a transformation as it aligns with the automotive industry’s evolving needs, including lightweighting for efficiency, safety enhancements, integration into electric and hybrid vehicles, and performance customization.

Related Reports

Indoor Flooring Market – Trends, Share [Latest] & Forecast

[2028] Geosynthetics Market Future, Outlook, Outlook, Segments

Table of Content-Germany Fiberglass Market

- Product Overview

1.1. Market Definition

1.2. Scope of the Market

1.2.1.Markets Covered

1.2.2.Years Considered for Study

1.2.3.Key Market Segmentations

- Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Formulation of the Scope

2.4. Assumptions and Limitations

2.5. Sources of Research

2.5.1.Secondary Research

2.5.2.Primary Research

2.6. Approach for the Market Study

2.6.1.The Bottom-Up Approach

2.6.2.The Top-Down Approach

2.7. Methodology Followed for Calculation of Market Size & Market Shares

2.8. Forecasting Methodology

2.8.1.Data Triangulation & Validation

- Executive Summary

- Impact of COVID-19 on Germany Fiberglass Market

- Voice of Customer

- Germany Fiberglass Market Overview

- Germany Fiberglass Market Outlook

7.1. Market Size & Forecast

7.1.1.By Value

7.2. Market Share & Forecast

7.2.1.By Glass Type (A-Glass, C-Glass, D- Glass, E-Glass, S-Glass and Others)

7.2.2.By Product Type (Glass Wool, Direct & Assembled Roving, Yarn and Chopped Strand)

7.2.3.By Resins (Thermoset Resins and Thermoplastic Resins)

7.2.4.By Application (Construction & Infrastructure, Automotive, Wind Energy, Electronics, Manufacturing, Marine and Others)

7.2.5.By Region (North-West, North-East, South-West and South-East)

7.3. By Company (2022)

7.4. Market Map

- North-West Germany Fiberglass Market Outlook

8.1. Market Size & Forecast

8.1.1.By Value

8.2. Market Share & Forecast

8.2.1.By Glass Type

8.2.2.By Product Type

8.2.3.By Resins

8.2.4.By Application

- North-East Germany Fiberglass Market Outlook

9.1. Market Size & Forecast

9.1.1.By Value

9.2. Market Share & Forecast

9.2.1.By Glass Type

9.2.2.By Product Type

9.2.3.By Resins

9.2.4.By Application