India Aluminium-Extruded Products market is expected to register a robust CAGR during the forecast period.

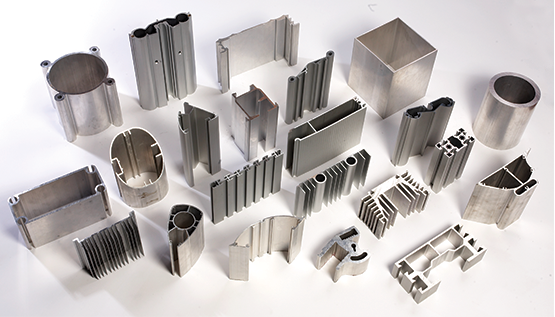

Aluminium extrusion is the process of shaping Aluminium using a mold cavity. In the extrusion process, the ram pushes the Aluminium product out of the mould and comes out with the same shape as the mould. After the extruded product has cooled, it is moved to a certain distance so that it is perfectly straight. There are basically three shapes of Aluminium extrusions: Hollow, Semi-Hollow and Solid. Aluminium extrusions are widely used in the building and construction, automotive and transportation, and electrical industries. Rising demand for lightweight and durable extruded products across various industries is expected to fuel the growth of the Aluminium extrusions market during the forecast period.

Aluminium’s lightweight and high strength-to-weight ratio make it ideal for large structures and buildings to provide additional strength at low weight. Additionally, the high corrosion resistance of extruded Aluminium is expected to boost demand in the electrical, electronic, and medical sectors. A thick layer of Aluminium oxide after anodizing or powder coating makes this type of extrusion very resistant to corrosion, unlike steel and iron. This leads to a reduction in maintenance costs for various industrial products. However, high initial set-up costs and low production efficiencies may adversely affect market growth.

Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=15098

Rising Demand of Aluminium-Extruded Products is Propelling the Growth Market

Building and Construction is an important sector for the aluminium extrusions market. In Federal Budget 2022-23, the Government of India has committed USD9.85 billion (Rs. 76,549 crore) to the Ministry of Housing and Urban Development. 100 PM-GatiShakti cargo terminals to be built for multimodal logistics facilities and will be developed in the next three years. Moreover, the government has given a huge boost to the infrastructure sector by allocating USD130.57 billion (Rs. 1 lakh crore). With these investments, the Indian aluminium extrusions market is expected to grow during the forecast period.

Aluminium Extrusion is considered a high-performance metal and plays an important role in the production of electric vehicles. This relates both to the manufacturing stage and to the charging infrastructure requirements. India is taking drastic steps for adoption of EVs by the 2030 as the NITI Aayog has prepared 2030 vision for the same. The vision expects to have 70% of India vehicles as EVs whether 2-wheeler, 3-wheeler or 4-wheeler. According to India Brand Equity Foundation (IBEF), by 2025, the Electric Vehicles Market is expected to be USD 6057 million. This is expected to drive the India Aluminium-Extruded Products Market during the forecast period.

Recent Developments

- In 2021, Norwegian Aluminium producer, Norsk Hydro ASA, sold its Kuppam extrusion plant to Hindalco for USD33 million. Located in Andhra Pradesh, the fully integrated facility has an Aluminium extrusion capacity of 15,000 tons per year and employs approximately 500 people as in-house staff or contractors. The Kuppam facility manufactures a wide range of extruded Aluminium products for automotive, architectural, industrial and construction applications. Hindalco expects to expand its presence in the emerging South Indian market.

- In 2020, Hindalco announced an investment of USD84.60 million to double its downstream production capacity. Hindalco also announced USD88.20 million investment to build his 34,000-ton extrusion facility in Silvassa. Hindalco’s new facility will serve the rapidly growing market for extruded Aluminium products in the western and southern regions. Over the next few years, as part of its downstream strategy, the company aims to increase capacity from its current 300,000 tonnes to more than 600,000 tonnes, requiring an investment of around USD846 million. The Silvassa facility will add 34,000 tonnes of capacity, focusing on his B&C segment, which accounts for more than 60% of his extrusion market excluding automotive, transportation and other segments.

Market Segments

India Aluminium-Extruded Products Market is segmented based on Product Type, End-Use Industry, Alloy Type, and Shape. Based on Product Type, the market is fragmented into Mill-Finished, Anodized and Powder-Coated. Based on End-Use Industry, the market is further fragmented into Building & Construction, Automotive & Transportation, Electrical & Electronics, Consumer Durables and Others. Based on Alloy Type, the market is fragmented into 1000 Series, 2000 Series, 3000 Series, 5000 Series, 6000 Series and 7000 Series. Based on Shape, the market is fragmented into Composite Shapes, Rods & Bars, and Pipes & Tubes.

Market Players

The market players in the India Aluminium-Extruded Products Market include Banco Aluminium Limited, Eagle Extrusion Private Limited, Alpro Extrusions Pvt. Ltd., Kunal Aluminium, Bhoruka Extrusions, Jindal Aluminium Limited, Maan Aluminium Limited, Hindalco Industries Ltd., The Superfine Group, Global Aluminium Pvt. Ltd

| Attribute | Details |

| Base Year | 2022 |

| Historic Data | 2018– 2021 |

| Estimated Year | 2023 |

| Forecast Period | 2024 – 2028 |

| Quantitative Units | Revenue in USD Million and CAGR for 2018-2022 and 2023-2028 |

| Report coverage | Revenue forecast, company share, growth factors, and trends |

| Segments covered | By Product TypeBy End-Use IndustryBy Alloy TypeBy ShapeBy Region |

| Regional scope | North, South, West, East |

| Key companies profiled | Banco Aluminium Limited, Eagle Extrusion Private Limited, Alpro Extrusions Pvt. Ltd., Kunal Aluminium, Bhoruka Extrusions, Jindal Aluminium Limited, Maan Aluminium Limited, Hindalco Industries Ltd., The Superfine Group, Global Aluminium Pvt. Ltd |

| Customization scope | 10% free report customization with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Scope:

In this report, India Aluminium-Extruded Products Markethas been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- India Aluminium-Extruded Products Market, By Product Type:

o Mill-Finished

o Anodized

o Powder-Coated

- India Aluminium-Extruded Products Market, By End-Use Industry:

o Building & Construction,

o Automotive & Transportation

o Electrical & Electronics

o Consumer Durables

o Others

- India Aluminium-Extruded Products Market, By Alloy Type:

o 1000 Series

o 2000 Series

o 3000 Series

o 5000 Series

o 6000 Series

o 7000 Series

- India Aluminium-Extruded Products Market, By Shape:

o Composite Shapes

o Rods & Bars

o Pipes & Tubes

- India Aluminium-Extruded Products Market, By Region:

o North

o South

o West

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Aluminium-Extruded Products Market.

Available Customizations:

Tech Sci Research offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players.

Related Reports

Smart Elevator Market [2028]: Trends & Forecast

Malaysia Elevator Modernization Market – Future, Scope, Trends [Latest]

Table of Content-India Aluminium-Extruded Products Market

- Product Overview

1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

- Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

- Impact of COVID-19 on India Aluminium-Extruded Products Market

- Voice of Customer

- India Aluminium-Extruded Products Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Product Type (Mill-Finished, Anodized and Powder-Coated)

6.2.2. By End-Use Industry (Building & Construction, Automotive & Transportation, Electrical & Electronics, Consumer Durables and Others)

6.2.3. By Alloy Type (1000 Series, 2000 Series, 3000 Series, 5000 Series, 6000 Series and 7000 Series)

6.2.4. By Shape (Composite Shapes, Rods & Bars and Pipes & Tubes)

6.2.5. By Region (North, South, West, East)

6.2.6. By Company (2022)

6.3. Market Map

- North India Aluminium-Extruded Products Meter Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Product Type

7.2.2. By End-Use Industry

7.2.3. By Alloy Type

7.2.4. By Shape

- South India Aluminium-Extruded Products Meter Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Product Type

8.2.2. By End-Use Industry

8.2.3. By Alloy Type

8.2.4. By Shape

- West India Aluminium-Extruded Products Meter Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Product Type

9.2.2. By End-Use Industry

9.2.3. By Alloy Type

9.2.4. By Shape

- East India Aluminium-Extruded Products Meter Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Product Type

10.2.2. By End-Use Industry

10.2.3. By Alloy Type

10.2.4. By Shape