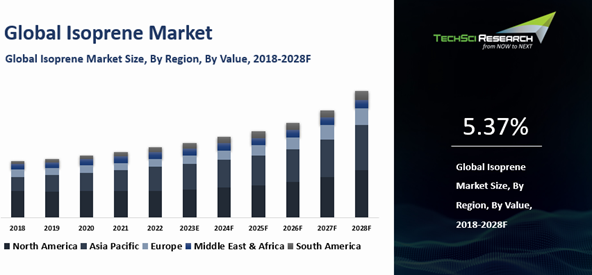

Global Isoprene Market was valued at USD 4628.43 million in 2022 and is anticipated to grow with a CAGR of 5.37% through 2028. The global isoprene market has witnessed substantial growth in recent years and is expected to sustain this upward trend. Isoprene, a colorless volatile liquid derived from petroleum or natural gas, plays a pivotal role as a key raw material in the production of synthetic rubber and other elastomers. With its versatile applications and growing demand across multiple industries, the global isoprene market offers significant opportunities for chemical companies. This growth is driven by factors such as the increasing demand for synthetic rubber, particularly in the automotive sector, and the expanding utilization of isoprene in various end-use segments including adhesives, coatings, and healthcare.

Key Market Drivers

Growing Use of Isoprene in Automotive IndustryThe automotive industry’s increased emphasis on sustainability and environmental responsibility has led to the emergence of what is commonly referred to as the “green tire” revolution. Isoprene, renowned for its remarkable ability to enhance the performance of synthetic rubber, stands at the forefront of this progressive movement. Synthetic rubber, a vital component in tire production, relies on isoprene to impart elasticity, durability, and excellent road grip. The utilization of isoprene in tire manufacturing plays a pivotal role in the development of tires with reduced rolling resistance, improved traction, and extended lifespan, all contributing to enhanced fuel efficiency and a more environmentally friendly automotive industry. The rise of electric vehicles (EVs) is another significant driver propelling the use of isoprene in the automotive industry. As EVs gain traction worldwide, the demand for tires specifically tailored to electric mobility is increasing. Isoprene’s role in crafting high-performance, energy-efficient tires is pivotal for the EV segment, as it directly impacts factors like range, battery longevity, and overall driving experience. As the automotive industry progresses towards a sustainable and technologically advanced future, isoprene emerges as a critical enabler of this journey. The role of isoprene in improving tire performance, fuel efficiency, and overall vehicle sustainability highlights its profound significance in shaping the automotive landscape.Growing Demand of Isoprene in Medical ApplicationsAs the world continues to witness remarkable advancements in medical science and technology, isoprene is emerging as a crucial ingredient with diverse applications in healthcare. Isoprene possesses unique properties that render it an optimal material to produce medical devices and equipment. Its exceptional elasticity and flexibility make it highly desirable for the fabrication of medical tubing, catheters, and syringe components. These materials necessitate biocompatibility, durability, and the ability to withstand diverse sterilization methods, making isoprene the preferred choice. As medical technology continues to advance, the growing demand for specialized and dependable medical devices underscores the significance of isoprene-based materials. Isoprene derivatives play a crucial role in the formulation of wound care products, including adhesive dressings and bandages.Isoprene-based adhesives offer excellent adhesion to the skin while allowing for easy and painless removal, a crucial factor in patient comfort. Additionally, isoprene’s gas permeability and moisture management properties contribute to creating advanced wound care products that promote optimal healing conditions. The pharmaceutical industry is currently experiencing a transition towards innovative drug delivery systems aimed at enhancing therapeutic outcomes and ensuring patient compliance. Isoprene-based polymers are being extensively investigated for their potential in sustained-release drug formulations, transdermal patches, and implantable drug delivery systems. These versatile polymers can be customized to regulate drug release rates, enhance bioavailability, and minimize adverse effects, thereby revolutionizing the field of medication administration. Moreover, in the healthcare sector, ensuring safety and infection control is of utmost importance. Isoprene-based materials are being utilized in the manufacturing of surgical gloves and protective apparel due to their exceptional strength, flexibility, and hypoallergenic properties. These materials provide healthcare professionals with indispensable protective equipment that guarantees the safety of both patients and providers during medical procedures.Growing Demand of Isoprene in Construction IndustryIn response to the construction sector’s growing need for sustainable and high-performance materials, isoprene has emerged as a crucial component with distinct properties and notable advantages. Construction materials infused with isoprene-based elastomers demonstrate exceptional durability and resilience to physical stresses and environmental factors. These qualities are highly sought-after in critical applications as roofing and sealing, where longevity and performance are of utmost importance. Isoprene-based sealants and adhesives offer superior bonding capabilities and moisture resistance, enhancing the structural integrity of construction projects. This proves particularly advantageous in applications that require water resistance and strong adhesion, such as window, door, and flooring installations. Furthermore, the escalating demand for construction materials, fueled by urbanization and infrastructure development, underscores the versatility of isoprene in meeting the diverse requirements of residential, commercial, and infrastructure projects. Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=2859

Key Market Challenges

Volatility in Prices of Raw MaterialsAs isoprene serves as a foundational building block for various products, its market stability is intricately linked to the costs and supply of its feedstocks. Isoprene is a hydrocarbon compound that can be derived from various raw materials such as crude oil, Natural Gas Liquids (NGLs), Synthesis Gas (Syngas), and bio-based feedstocks. Raw material prices are known for their inherent volatility, influenced by a complex interplay of geopolitical factors, supply-demand imbalances, and unforeseen events. This volatility significantly impacts the stability of isoprene production costs and introduces uncertainties that have far-reaching effects in the market.Disruptions in Supply ChainIsoprene, a crucial element in the manufacturing of various products, including tires and adhesives, is subject to the influence of multiple factors that have the potential to disrupt its supply chain. Political instability, trade tensions, and geopolitical events have the potential to disrupt the flow of raw materials across borders, impacting the availability of isoprene feedstocks and causing delays in the supply chain. Manufacturing facilities that produce isoprene can be vulnerable to operational disruptions, such as equipment failures, maintenance issues, or unexpected shutdowns. These disruptions can result in shortages and impact the reliability of the supply chain. Additionally, increasing environmental regulations and sustainability requirements may have implications on the production and distribution of isoprene, necessitating adjustments in manufacturing processes and potential modifications to the supply chain.

Key Market Trends

Technological AdvancementsIsoprene, a versatile hydrocarbon compound, has been widely used in diverse industries, from rubber production to pharmaceuticals. However, advancements in technology are now unlocking unprecedented possibilities for isoprene, catalyzing its evolution, and driving transformative changes across multiple sectors. Advanced catalytic processes, such as metathesis and oxidative dehydrogenation, are revolutionizing production methods for enhanced efficiency and sustainability. These advancements not only optimize yield and minimize waste but also yield cost savings and environmental advantages. Technological breakthroughs are elevating the characteristics of isoprene-derived materials. Nanotechnology enables precise manipulation of material properties at the nanoscale, resulting in the development of high-performance isoprene-based materials with superior strength, durability, and functional attributes. Bridgestone Corporation has announced the initiation of a collaborative research and development program with the National Institute of Advanced Industrial Science and Technology (AIST), Tohoku University, ENEOS, and JGC HOLDINGS CORPORATION. The primary objective of this program is to advance the development of chemical recycling technologies that effectively utilize discarded tires, resulting in high-yield production of isoprene, a crucial raw material for synthetic rubber. By leveraging the collective expertise and technologies of industry-leading companies and academic institutions, Bridgestone is dedicated to the creation of innovative recycling technologies that will contribute to the realization of a more sustainable society. Furthermore, the company aims to conduct comprehensive demonstrations to facilitate the social implementation of these technologies by 2030.Growing Sustainability in Isoprene ProductionAs industries across various sectors transition towards more environmentally conscious practices, the production of isoprene, a crucial hydrocarbon with versatile applications, is embracing this paradigm shift. The growing focus on sustainability in isoprene production is emerging as a transformative trend that not only aligns with environmental objectives but also shapes the future of the global isoprene market. The isoprene market, traditionally associated with petrochemical feedstocks, is now embracing sustainability to mitigate its environmental impact. Conventional methods of isoprene production, reliant on fossil fuels, are being reevaluated in favor of greener alternatives that contribute to the circular economy and minimize greenhouse gas emissions. Bio-based isoprene, derived from renewable feedstocks such as biomass and agricultural waste, has garnered attention as a sustainable substitute for petroleum-based isoprene. The cultivation of feedstock sources like corn, sugarcane, and wood chips offers a more environmentally friendly approach to isoprene production, reducing the industry’s reliance on fossil resources. Furthermore, sustainability initiatives in isoprene production aim to significantly reduce carbon emissions, making the process more environmentally friendly. Renewable feedstocks, combined with innovative production technologies, have the potential to substantially decrease the carbon footprint associated with isoprene manufacturing. Sustainable isoprene production focuses on optimizing resource utilization and minimizing waste generation. By adopting efficient production processes and utilizing waste streams as feedstock, the industry can reduce its environmental impact and contribute to a circular economy.

Segmental Insights

Application InsightsIn 2022, the isoprene market was dominated by the tires segment and is predicted to continue expanding over the coming years. This is attributed to its extensive utilization in tire manufacturing across various vehicle types. Isoprene is used in small quantities and combined with isobutylene to produce isobutylene-isoprene rubber, formerly known as butyl rubber. These rubbers find primary application in tire inner liners, offering robust mechanical properties at a low cost, thereby driving their adoption in diverse engineering applications. Consequently, tire manufacturers heavily rely on isoprene to construct resilient and long-lasting tires for vehicles. The growing automotive industry in strong economies like China, India, the U.S., Germany, France, and others serves as a major driver for tire demand, thus positively influencing the growth of the isoprene market.

Type Insights

In 2022, the isoprene market was dominated by the polymerization grade segment and is predicted to continue expanding over the coming years. This can be attributed to the similarities of its applications to natural rubber. Polyisoprene is formed by the combination of multiple isoprene molecules, resulting in four isomers, with cis- and trans-isoprene being the most significant. The growing market demand for the polymer-grade product is driven by its various properties, including cold resistance, high resilience, and good tensile strength. Isoprene, a transparent and colourless liquid with a concentration of 99.3%, is widely used in various industries. Polymer-grade isoprene is utilized to manufacture polyisoprene, which finds applications in tires, mechanical molded goods, motor mounts, shock-absorber bushings, and pipe gaskets. The increasing utilization of polyisoprene in a wide range of industrial products is expected to fuel the market demand for polymer-grade isoprene in the upcoming years. Related ReportsPetroleum Resin Market [2028] – Report & Market ShareCosmetic Pigments Market [2028]: Analysis & Forecast Table of Content- Isoprene Market

- Research Methodology

2.1. Objective of the Study2.2. Baseline Methodology2.3. Key Industry Partners2.4. Major Association and Secondary Sources2.5. Forecasting Methodology2.6. Data Triangulation & Validation2.7. Assumptions and Limitations

- Executive Summary

3.1. Overview of the Market3.2. Overview of Key Market Segmentations3.3. Overview of Key Market Players3.4. Overview of Key Regions/Countries3.5. Overview of Market Drivers, Challenges, Trends

- Voice of CustomerGlobal Isoprene Market Outlook

5.1. Market Size & Forecast5.1.1. By Value & Volume5.2. Market Share & Forecast5.2.1. By Type (Polymerization Grade and Chemical Grade)5.2.2. By Application (Polyisoprene, SIS, IIR, Others)5.2.3. By End Use Industry (Tires, Non-Tire, Adhesives, Others)5.2.4. By Region5.2.5. By Company (2022)5.3. Market Map

- North America Isoprene Market Outlook

6.1. Market Size & Forecast6.1.1. By Value & Volume6.2. Market Share & Forecast6.2.1. By Type6.2.2. By Application6.2.3. By End Use Industry6.2.4. By Country6.3. North America: Country Analysis6.3.1. United States Isoprene Market Outlook6.3.1.1. Market Size & Forecast6.3.1.1.1. By Value & Volume6.3.1.2. Market Share & Forecast6.3.1.2.1. By Type6.3.1.2.2. By Application6.3.1.2.3. By End Use Industry6.3.2. Mexico Isoprene Market Outlook6.3.2.1. Market Size & Forecast6.3.2.1.1. By Value & Volume6.3.2.2. Market Share & Forecast6.3.2.2.1. By Type6.3.2.2.2. By Application6.3.2.2.2. By End Use Industry6.3.3. Canada Isoprene Market Outlook6.3.3.1. Market Size & Forecast6.3.3.1.1. By Value & Volume6.3.3.2. Market Share & Forecast6.3.3.2.1. By Type6.3.3.2.2. By Application6.3.3.2.2. By End Use Industry

- Europe Isoprene Market Outlook

7.1. Market Size & Forecast7.1.1. By Value & Volume7.2. Market Share & Forecast7.2.1. By Type7.2.2. By Application7.2.3. By End Use Industry7.2.4. By Country7.3 Europe: Country Analysis7.3.1. France Isoprene Market Outlook7.3.1.1. Market Size & Forecast7.3.1.1.1. By Value & Volume7.3.1.2. Market Share & Forecast7.3.1.2.1. By Type7.3.1.2.2. By Application7.3.1.2.2. By End Use Industry7.3.2. Germany Isoprene Market Outlook7.3.2.1. Market Size & Forecast7.3.2.1.1. By Value & Volume7.3.2.2. Market Share & Forecast7.3.2.2.1. By Type7.3.2.2.2. By Application7.3.2.2.2. By End Use Industry7.3.3. United Kingdom Isoprene Market Outlook7.3.3.1. Market Size & Forecast7.3.3.1.1. By Value & Volume7.3.3.2. Market Share & Forecast7.3.3.2.1. By Type7.3.3.2.2. By Application7.3.3.2.2. By End Use Industry7.3.4. Italy Isoprene Market Outlook7.3.4.1. Market Size & Forecast7.3.4.1.1. By Value & Volume7.3.4.2. Market Share & Forecast7.3.4.2.1. By Type7.3.4.2.2. By Application7.3.4.2.2. By End Use Industry7.3.5. Spain Isoprene Market Outlook7.3.5.1. Market Size & Forecast7.3.5.1.1. By Value & Volume7.3.5.2. Market Share & Forecast7.3.5.2.1. By Type7.3.5.2.2. By Application7.3.5.2.2. By End Use Industry

- Asia-Pacific Isoprene Market Outlook

8.1. Market Size & Forecast 8.1.1. By Value & Volume8.2. Market Share & Forecast8.2.1. By Type8.2.2. By Application8.2.3. By End Use Industry8.2.4. By Country8.3. Asia-Pacific: Country Analysis8.3.1. China Isoprene Market Outlook8.3.1.1. Market Size & Forecast8.3.1.1.1. By Value & Volume8.3.1.2. Market Share & Forecast8.3.1.2.1. By Type8.3.1.2.2. By Application8.3.1.2.3. By End Use Industry8.3.2. India Isoprene Market Outlook8.3.2.1. Market Size & Forecast8.3.2.1.1. By Value & Volume8.3.2.2. Market Share & Forecast8.3.2.2.1. By Type8.3.2.2.2. By Application8.3.2.2.3. By End Use Industry8.3.3. South Korea Isoprene Market Outlook8.3.3.1. Market Size & Forecast8.3.3.1.1. By Value & Volume8.3.3.2. Market Share & Forecast8.3.3.2.1. By Type8.3.3.2.2. By Application8.3.3.2.3. By End Use Industry8.3.4. Japan Isoprene Market Outlook8.3.4.1. Market Size & Forecast8.3.4.1.1. By Value & Volume8.3.4.2. Market Share & Forecast8.3.4.2.1. By Type8.3.4.2.2. By Application8.3.4.2.3. By End Use Industry8.3.5. Australia Isoprene Market Outlook8.3.5.1. Market Size & Forecast8.3.5.1.1. By Value & Volume8.3.5.2. Market Share & Forecast8.3.5.2.1. By Type8.3.5.2.2. By Application8.3.5.2.3. By End Use Industry