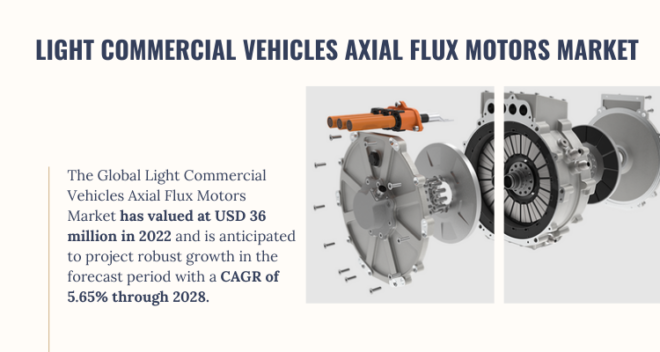

According to TechSci Research report, “Global Light Commercial Vehicles Axial Flux Motors Market – Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the Global Light Commercial Vehicles Axial Flux Motors Market stood at USD 36 million in 2022 and is anticipated to grow with a CAGR of 5.65% in the forecast period, 2024-2028.

The global light commercial vehicle (LCV) axial flux motors market is poised at the forefront of the transportation industry’s transformation towards sustainability, efficiency, and electrification. In response to environmental concerns and increasingly stringent emissions regulations, there is a growing momentum to electrify LCVs, and axial flux motors have emerged as a pivotal component in this transition.

These motors offer a compelling solution, characterized by their high efficiency, compact design, and versatility in various commercial applications. As governments worldwide set ambitious emission reduction targets, fleet operators and businesses are turning to electric LCVs equipped with axial flux motors to align with these regulatory mandates and reduce their carbon footprint.

The market is not without its challenges, including cost considerations, energy density limitations, infrastructure development, integration complexities, and the need for market education.

However, these challenges are driving innovation, collaboration, and investment in the electric LCV sector. The demand for electric LCVs is growing as businesses recognize the long-term cost savings and environmental benefits associated with them. Furthermore, as battery technology evolves, electric LCVs are expected to overcome range limitations and provide the extended driving ranges necessary for various commercial applications. The ongoing development of charging infrastructure will facilitate convenient access to fast-charging stations, minimizing downtime for LCV fleets.

Browse over market data Figures spread through 180 Pages and an in-depth TOC on“Global Light Commercial Vehicles Axial Flux Motors Market.” @ https://www.techsciresearch.com/report/light-commercial-vehicles-axial-alux-motors-market/18952.html

The global light commercial vehicle (LCV) axial flux motors market is experiencing a profound transformation driven by the imperative to make commercial transportation more sustainable, efficient, and electrified. As environmental concerns mount and governments worldwide tighten emissions regulations, the transition to electric LCVs has gained substantial momentum, with axial flux motors emerging as a linchpin technology in this paradigm shift.

These motors, known for their remarkable efficiency, compact design, and adaptability to diverse commercial applications, are playing a pivotal role in reshaping the future of LCV propulsion. The adoption of electric LCVs equipped with axial flux motors is driven primarily by two intertwined factors: the urgent need to reduce emissions and the rapid technological advancements in electric vehicle (EV) technology.

Governments across the globe are imposing increasingly stringent emissions standards to combat climate change and enhance air quality. In response, businesses and fleet operators are seeking cleaner, greener alternatives to traditional internal combustion engine (ICE) vehicles, turning their attention to electric LCVs as a viable solution.

The inherent efficiency of axial flux motors positions them as a cornerstone of this transition. These motors boast a high power-to-weight ratio, making them well-suited for commercial applications where torque and efficiency are paramount. When integrated into electric LCVs, axial flux motors enhance overall performance, offering superior power delivery and energy efficiency, ultimately reducing operational costs and minimizing the carbon footprint of commercial fleets.

Cost considerations pose a substantial barrier to entry for both automakers and fleet operators. While axial flux motors offer significant advantages, including higher efficiency and power density, they tend to be more expensive to manufacture than traditional radial flux motors. This elevated manufacturing cost can impact the price of electric LCVs, making it difficult for them to compete with their ICE counterparts on the basis of initial purchase price alone. Overcoming this challenge necessitates innovative cost-reduction strategies, such as scaling up production and exploring advanced manufacturing techniques.

Energy density limitations are intrinsically tied to the range of electric LCVs. Despite axial flux motors’ ability to optimize efficiency, the range of these vehicles is largely determined by the capacity of the onboard batteries. While progress has been made in battery technology, including increased energy density and faster charging capabilities, challenges persist. Commercial vehicles often require extended ranges to meet the demands of various applications, such as delivery routes or transportation services. Overcoming these range limitations while maintaining affordability is crucial to the widespread adoption of electric LCVs.

Charging infrastructure development and accessibility presents another significant challenge. For electric LCVs to be practical, reliable, and convenient charging stations must be readily available. The absence of a robust charging network can hinder the adoption of electric LCVs, particularly in regions where access to charging infrastructure is limited. The development of fast-charging infrastructure is also imperative to minimize downtime for commercial vehicles during recharging. Governments and private entities must invest in charging infrastructure development to support the electrification of LCV fleets effectively.

Market education and awareness represent a distinct challenge in the global LCV axial flux motors market. Many stakeholders in the commercial vehicle sector may have limited familiarity with electric propulsion and the benefits of axial flux motors.

Transitioning from traditional ICE vehicles to electric LCVs requires a significant change in mindset, operational practices, and infrastructure planning. Fleet operators need to understand the economic and environmental advantages of electric LCVs, as well as the long-term savings and reduced total cost of ownership. Market education efforts, including training programs, informational campaigns, and collaboration between industry stakeholders and government bodies, are crucial to bridge the knowledge gap and accelerate the adoption of axial flux motors in the commercial vehicle sector.

Major companies operating in the Global Light Commercial Vehicles Axial Flux Motors Market are:

- Magnax BV

- YASA Limited

- Nidec Corporation

- Saietta Group

- EMRAX

- Whylot Electromechanical Solutions

- Agni Motors Ltd,

- Turntide Technologies

- Elaphe Propulsion Technologies,

- Brusa Elektronik AG

- PML Flightlink Ltd.

Your Free sample Report PDF is just a click away! @ https://www.techsciresearch.com/sample-report.aspx?cid=18952

Customers can also request for 10% free customization on this report.

“The global light commercial vehicle axial flux motors market is at the forefront of a transformative shift toward sustainability and electrification in commercial transportation. Axial flux motors, known for their efficiency and adaptability, are playing a pivotal role in powering electric LCVs, addressing environmental concerns and stringent emissions regulations. While challenges like cost, range limitations, charging infrastructure, integration complexities, and market education persist, they are driving innovation and collaboration. As governments incentivize electric mobility and businesses seek cost-effective, eco-friendly transportation solutions, the demand for axial flux motors is poised to grow. The market’s evolution represents a crucial step toward achieving cleaner, more efficient, and economically viable commercial transportation, contributing to a greener and sustainable future.,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Light Commercial Vehicles Axial Flux Motors Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Propulsion (BEV, HEV, PHEV), By Demand Category (OEM, Aftermarket) By Region, By Competition, 2018-2028”, has evaluated the future growth potential of Global Light Commercial Vehicles Axial Flux Motors Market and provides statistics & information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Light Commercial Vehicles Axial Flux Motors Market.

You may also read:

Air Suspension Market Projects 7.5% CAGR, USD 6.5 Billion Valuation in 2022

Germany Automotive Acoustic Engineering Services Market Tops USD 490 Million in 2022, Growth on Horizon

Electric Commercial Vehicle Components Market 8.32% CAGR Forecasted, Driving Future Expansion

Electric Passenger Car Components Market Evolving Landscape, Envisions Growth at USD 152.83 Billion

Passenger Car ABS Motor Circuit Market Reaches USD 22.73 Billion in 2022, Poised for 6.41% CAGR Growth

Table of Content-Light Commercial Vehicles Axial Flux Motors Market

- Introduction

1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

- Research Methodology

2.1. Objective of theStudy

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

- Impact of COVID-19 on Global Light Commercial Vehicles Axial Flux Motors Market

- Global Light Commercial Vehicles Axial Flux Motors Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value & Volume

5.2. Market Share & Forecast

5.2.1. By Propulsion Type Market Share Analysis (BEV, HEV, PHEV)

5.2.2. By Demand Category Market Share Analysis (OEM, Aftermarket)

5.2.3. By Regional Market Share Analysis

5.2.3.1. Asia-Pacific Market Share Analysis

5.2.3.2. Europe & CIS Market Share Analysis

5.2.3.3. North America Market Share Analysis

5.2.3.4. South America Market Share Analysis

5.2.3.5. Middle East & Africa Market Share Analysis

5.2.4. By Company Market Share Analysis (Top 5 Companies, Others – By Value & Volume, 2022)

5.3. Global Light Commercial Vehicles Axial Flux Motors Market Mapping & Opportunity Assessment

5.3.1. By Propulsion Type Market Mapping & Opportunity Assessment

5.3.2. By Demand Category Market Mapping & Opportunity Assessment

5.3.3. By Regional Market Mapping & Opportunity Assessment

- Asia-Pacific Light Commercial Vehicles Axial Flux Motors Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value & Volume

6.2. Market Share & Forecast

6.2.1. By Propulsion Type Market Share Analysis

6.2.2. By Demand Category Market Share Analysis

6.2.3. By Country Market Share Analysis

6.2.3.1. China Market Share Analysis

6.2.3.2. India Market Share Analysis

6.2.3.3. Japan Market Share Analysis

6.2.3.4. Indonesia Market Share Analysis

6.2.3.5. Thailand Market Share Analysis

6.2.3.6. South Korea Market Share Analysis

6.2.3.7. Australia Market Share Analysis

6.2.3.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value & Volume

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Propulsion Type Market Share Analysis

6.3.1.2.2. By Demand Category Market Share Analysis

6.3.2. India Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value & Volume

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Propulsion Type Market Share Analysis

6.3.2.2.2. By Demand Category Market Share Analysis

6.3.3. Japan Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value & Volume

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Propulsion Type Market Share Analysis

6.3.3.2.2. By Demand Category Market Share Analysis

6.3.4. Indonesia Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value & Volume

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Propulsion Type Market Share Analysis

6.3.4.2.2. By Demand Category Market Share Analysis

6.3.5. Thailand Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value & Volume

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Propulsion Type Market Share Analysis

6.3.5.2.2. By Demand Category Market Share Analysis

6.3.6. South Korea Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value & Volume

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Propulsion Type Market Share Analysis

6.3.6.2.2. By Demand Category Market Share Analysis

6.3.7. Australia Light Commercial Vehicles Axial Flux Motors Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value & Volume

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Propulsion Type Market Share Analysis

6.3.7.2.2. By Demand Category Market Share Analysis

- Europe & CIS Light Commercial Vehicles Axial Flux Motors Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value & Volume

7.2. Market Share & Forecast

7.2.1. By Propulsion Type Market Share Analysis

7.2.2. By Demand Category Market Share Analysis

7.2.3. By Country Market Share Analysis

7.2.3.1. Germany Market Share Analysis

7.2.3.2. Spain Market Share Analysis

7.2.3.3. France Market Share Analysis

7.2.3.4. Russia Market Share Analysis

7.2.3.5. Italy Market Share Analysis

7.2.3.6. United Kingdom Market Share Analysis

7.2.3.7. Belgium Market Share Analysis

7.2.3.8. Rest of Europe & CIS Market Share Analysis