From facing a major supply crunch to slumping car sales, fluctuating oil prices to a sudden spike in delivery demand, semiconductor shortages to low inventories, the automotive industry faced some major challenges in 2020 and 2021, mainly due to disruptions caused by the COVID-19 pandemic. However, these disruptions have also accelerated developments in the automotive landscape, which are mainly positive. Now, consumers are increasingly transitioning towards reliable, efficient, and green transport. Also, new electrification startups are emerging due to enhanced focus on sustainability, and automobile manufacturers are introducing more offerings for autonomous, connected, and smart vehicles with even better technologies. These revolutionary changes are shaping the way vehicles are manufactured, shopped, driven, or acquired.

As the automotive industry is undergoing some major fundamental restructuring, devising new strategies and business models has become pivotal for companies for their future prosperity and to make the lives of the consumers more enjoyable, efficient, and safer. Here are the key trends that will dominate the automotive industry in 2022 and influence operational and purchasing decisions.

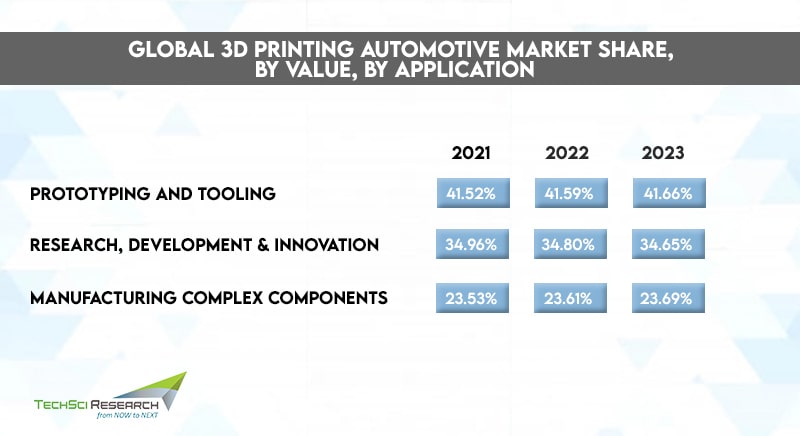

Use of 3D Printing Technologies for Additive Manufacturing

To take advantage of the momentum in adoption of 3D printing, companies involved in additive manufacturing have spent 2021 developing and perfecting new machines and materials to better serve the consumers. The advanced technology presented itself as a viable solution to overcome pandemic related issues such as labor shortages and supply chain vulnerabilities. With increased focus on volume manufacturing and sustainability, automotive manufacturers are rapidly adopting the technology for building more reliable, flexible, and interoperable products. Major automotive companies are optimizing the production process and streamlining logistics to create better-performing vehicles and stay innovative amid the changing dynamics of the industry. Antimanufacturing giants like General Motors, Ford, Tesla, BMW, and many others have realized the commercial benefits of 3D printing in additive manufacturing such as reduced overall lead time, enhanced market responsiveness, elimination of supply chain complexity, etc. With the growing demand for lighter parts in electric vehicles, many manufacturers are utilizing the 3D printing technology in their production and development processes.

- More Companies Venturing into the Microchip Market

With increasingly sophisticated cars devouring more and more computing power, the need for semiconductors in the automobile industry has plummeted. The shortage of semiconductors caused by pandemic resulted in the temporary shutdown of factories and delayed car deliveries due to flattened inventories, which cost the global automotive industry billions of dollars. Even though 2022 is approaching, the problem of semiconductor shortage persists, creating a significant hurdle for the automotive sector for future operation and sales. Hence, some OEMs are taking matters into their own hands to fulfill the microchip demand, initiating in-house production of microprocessors. Ford has recently partnered with the US chipmaker, GlobalFoundries to relieve semiconductor shortages and maintain a steady stream of products. General Motors has collaborated with MP Materials to focus on sourcing rare earth magnets, essential for EV motors. The European Union also wants to get in the chip process and claim 20% of the world’s semiconductor production by 2030. Alliances and collaboration will become even more crucial in the coming years as the need for connected and autonomous vehicles is growing rapidly.

- Increasing Adoption of Connected Vehicles

Cellular Vehicle-to-Everything (C-V2X) technologies and the specification’s ecosystem are gaining traction with increasing demand for autonomous vehicles and favorable initiatives by the government for infrastructure developments. The technology enables the exchange of critical information between vehicles to prevent road accidents and enhance situational awareness. The growing number of pedestrian fatalities and development of advanced C-V2X platforms to support the commercialization of connected infrastructure are enabling the technology to become mainstream. The main uses of C-V2X include safety and traffic efficiency that encompasses collision avoidance, hazards, or road construction warnings, etc. Construction vehicles will increasingly begin utilizing the technology to operate autonomously in a non-line of sight using the C-V2X technologies. Thus, the global demand for cars connected to the Internet of Things is expected to explode in 2022 with the enhanced use of predictive intelligence and maintenance technology. The next generation of connected vehicles will allow bikes or mobility scooters to have the same kind of technology found in cars to make fleet management more efficient.

- Wireless EV Charging to Increase EV Adoption

The remarkable changes in electric vehicle technology are leading to advancements in EV charging infrastructure. Although EV charging stations are quite handy and efficient, different plug standards and their inadequate infrastructure can be quite overwhelming for many vehicle owners. Thus, wireless EV charging solutions can prove to be a viable solution to such issues and play an important role in boosting the adoption of electric vehicles. The simplicity and less driver intervention of the wireless electric vehicle chargers combined with their high energy transfer efficiency can be the real game-changer for enhancing electrification in the automotive industry. The newest technology for wireless EV charging, Induction Pads, utilize a magnetic field to initiate the battery charging process and stop when the battery gets full. Besides, the rapidly growing need for charging electric vehicles is leading to the development of power banks.

- More Demand for Alternate Fuel Vehicles

Due to growing environmental awareness and fluctuating gas prices, the demand for alternative energy solutions that offer great sustainability is increasing. Additionally, rising investments by vehicle manufacturers and government subsidies are boosting the adoption of alternative fuel vehicles globally. Most common alternative fuel sources for automobiles include hydrogen, ethanol, electricity, biodiesel, natural gas, and propane. Alternative fuels are domestically produced, which reduces dependence on imported oils.

Ethanol is derived from corn or other crops, and it produces less greenhouse gas emissions. Electricity is produced from a variety of sources like natural gas, coal, nuclear power, or other renewable sources and they cause no tailpipe emissions. Biodiesel is derived from vegetable oils and animal fats, and it produces less air pollutants than petrol or diesel. Natural gas is another viable alternate fuel that causes fewer pollutants than gasoline. Hydrogen can be produced from fossil fuels, nuclear power, water, electricity, biomass, renewable power, etc. Some car companies have been researching and developing hydrogen-powered fuel-cell vehicles that provide three times the efficiency of gas-powered vehicles and have zero emissions. Honda’s Clarity Fuel Cell, Hyundai’s Nexo Fuel Cell SUV, and Toyota’s Mirai and six other vehicles are currently utilizing the fuel cell technology. However, high cost of cars and a limited network of hydrogen fueling stations are some of the factors limiting the adoption of fuel cell technologies.

- More Self-driving Vehicles to Make Entry

There are many automakers working on the self-driving initiative to make full automation (Level 4) a reality. Recent technological advancements in the field of machine learning and artificial intelligence have enabled manufacturers to increase self-driving capabilities of cars. Major players are developing more advanced control systems that can interpret sensory inputs. Currently, most autonomous vehicles that are available in the market are Level 1, Level 2, and Level 3 with advanced driver assistance systems like adaptive cruise control, collision detection, lane departure warning, etc. Audi has ventured into autonomous driving with a budget of approx. 16 billion to deploy hands-free driving in its A8 sedan model. General Motors has unveiled a self-driving six-seater, called Origin which lacks a steering wheel, brake, accelerator pedals, rear-view mirror, etc. which will be unveiled in its upcoming models. Honda Motors has received approval for testing its Level-3 autonomous vehicles on roads. The vehicle is equipped with an autonomous technology called Traffic Jam Pilot that collects data on the vehicle’s movement and help it navigate through congested highways. Volvo has planned to integrate LiDAR and perception stack into its vehicles in 2022.

- Increasing Collaborations between Technology and Automobiles

The automotive companies are increasingly collaborating with high-tech companies to expand their offerings and gain a competitive edge. Technology has a major role to play in shaping the automobile industry over decades as it allows OEMs to integrate high-tech features like autonomous driving, advanced driver-assistance systems (ADAS), etc. As driverless cars and electric vehicles continue to expand in the automotive space, the need to combine advanced technologies in upcoming models will grow. Car, truck, and SUV makers are making huge investments in their technology divisions for R&D or collaborating with tech firms for designing and producing new operating systems. As autonomous vehicle technology is reaching an inflection point, more big tech giants, autonomous vehicle developers, and suppliers are forming collaborations to bring self-driving solutions to the market.

- Rise of Digital Automotive Retailing

When it comes to digital automotive retailing, tech-savvy dealerships have largely lagged behind. However, with the growth of digital channels offering the sale of new and pre-owned car models, the digital automotive retail market is gaining traction. Now, consumers narrow down their car model choice to just one or two models before visiting dealerships. YouTube and professional reviews are playing a large role in influencing consumers’ choices. The digital shift means marketers need to be more considerate of multi-channel retailing. The more the shoppers are exposed to remote communication and actual online buying options, the more they prefer digital mediums over traditional showrooms.