Continuously growing electricity demand, favorable Feed-in-Tariffs (FiT) and rising government concerns towards greenhouse emissions to drive Vietnam solar photovoltaics equipment through 2026.

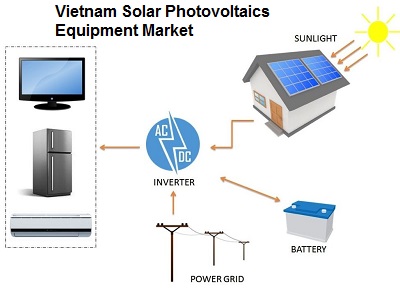

According to TechSci Research report, “Vietnam Solar Photovoltaics Equipment Market By DC Voltage Type (400V, 600V, 1000V & 1500V), By Installation Mode (Ground Mounted Vs Rooftop), By End User (Industrial, Commercial & Residential), By Module Type (Monocrystalline, Polycrystalline & Thin Film), By Type (Circuit Configuration, Module Mounting Systems, Solar Charge Controllers, etc.), Competition, Forecast & Opportunities, 2016-2026”.

Vietnam solar photovoltaics equipment market is forecast to grow at a CAGR of 12.09%, in value terms, to reach USD3514.65 million by 2026. Growth in the market is anticipated on account of increasing electricity demand from industrial, commercial as well as residential end user segments. With favorable initiatives taken in the solar sector by the Government of Vietnam, an increasing number of investors and developers are also increasing their investments in solar industry in different regions across the country.

Vietnam relies heavily on foreign direct investment (FDI) to grow its economy and is one of the most open economies in the world. Moreover, in Vietnam, large solar PV projects have received loans from international financing institutions – a trend likely to continue as there seems to be a growing appetite to finance such projects and lenders are starting to get familiar with assessing and mitigating underlying risks.

The government offers some preferential policies and other financial incentives such as preferential tax and duty levies for growth in the solar sector. Positive FiT incentives have proven to be the most effective policy for renewable energy growth. The engagement of local commercial banks to finance the rooftop investment portfolio has built momentum for rooftop solar leasing. The residents require further incentives like the national rooftop solar programme, supported by German state-owned development bank KfW. The sponsorship mechanism must be implemented as soon as possible to maintain the eagerness of individual installers.

Browse 29 Figures and 1 Tables spread through 76 Pages and an in-depth TOC on “Vietnam Solar Photovoltaics Equipment Market”.

https://www.techsciresearch.com/report/vietnam-solar-photovoltaics-equipment-market/4723.html

In 2019, Vietnam solar photovoltaic equipment market was dominated by the polycrystalline type of module due to its cheap price. However, the monocrystalline type of module is forecast to grow at a high CAGR through 2026 on account of higher efficiency in solar systems for energy generation. Over the last few years, the government has taken various initiatives in the solar power sector such as the upgradation of power development plan, introduced net metering scheme for solar rooftop projects, and revised FiT for solar projects. The government is now considering moving from FiT to a competitive bidding scheme for solar projects that would increase the installed capacity and create thousands of new jobs in Vietnam. It is expected that 400MW of floating PV will be tendered in 2020 and 2021, to further boost solar market in the country. In 2017, the government introduced FiT of USD9.35 cents/kWh, which generated interest in solar projects, majorly in the southern regions of Vietnam. In 2019, the government revised the FiT, varying from USD6.67-10.87 cents/kWh, dependent on solar power technology and region of deployment. As a result, the cumulative solar capacity of the country reached 5.5 GW in 2019 from 237 MW in 2018.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=4723

Customers can also request for 10% free customization on this report.

“As of 2019, Vietnam overtook Malaysia and Thailand to reach the largest installed capacity of solar panels in Southeast Asia. The country installed 5 gigawatts of photovoltaic projects exceeding its target of 1 gigawatt by 2020. It has also moved to a new approach of competitive bidding of the solar projects which is expected to increase the installed capacity and create thousands of new jobs in Vietnam. Although the feed-in-tariffs (FIT) has been useful in past years, it has also given rise to new issues such as curtailment and underuse of solar generation capacity. The new approach would address the curtailment issue and improve risk allocation between public and private investors. With rising number of initiatives taken by the Government of Vietnam in the solar power sector, an increasing number of solar companies are investing in solar power projects across different geographical locations of the country. Anticipated growth in the solar power projects across Vietnam is expected to boost the demand for solar photovoltaics equipment in the coming years.” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“Vietnam Solar Photovoltaics Equipment Market By DC Voltage Type (400V, 600V, 1000V & 1500V), By Installation Mode (Ground Mounted Vs Rooftop), By End User (Industrial, Commercial & Residential), By Module Type (Monocrystalline, Polycrystalline & Thin Film), By Type (Circuit Configuration, Module Mounting Systems, Solar Charge Controllers, etc.), Competition, Forecast & Opportunities, 2016-2026”, has evaluated the future growth potential of the Vietnam solar photovoltaics equipment market and provided statistics and information on market size, shares, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Vietnam solar photovoltaics equipment market.

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]