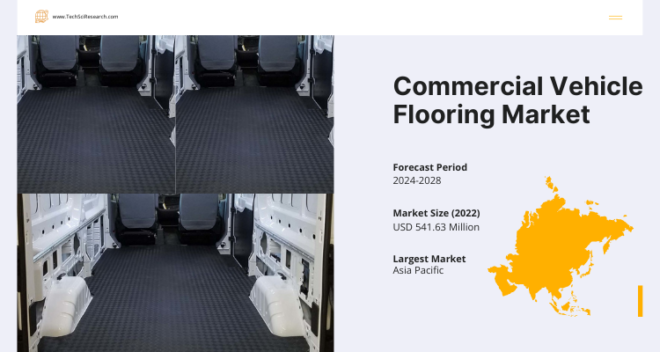

According to TechSci Research report, “Commercial Vehicle Flooring Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the Global Commercial Vehicle Flooring Market stood at USD 541.63 Million in 2022 and is anticipated to grow with a CAGR of 6.21% in the forecast period, 2024-2028

The Global Commercial Vehicle Flooring Market encompasses a dynamic landscape that caters to the diverse needs of commercial vehicle operators and businesses worldwide. This market segment revolves around the provision of durable and functional flooring materials for a wide array of commercial vehicles, ranging from compact vans to heavy-duty trucks and buses.

One of the defining characteristics of this market is its commitment to safety and compliance. Flooring materials must adhere to stringent regulatory standards, ensuring the well-being of passengers and cargo. These standards encompass aspects like slip resistance, fire retardance, and environmental compliance. Manufacturers continually innovate to meet these requirements while delivering flooring solutions that balance safety, practicality, and aesthetics.

Sustainability is another crucial aspect of the Global Commercial Vehicle Flooring Market. Eco-friendly and recyclable materials are gaining prominence, aligning with global sustainability goals. Manufacturers are exploring innovative ways to incorporate these materials into their offerings, responding to the industry’s increasing focus on environmental responsibility.

Customization options have become a hallmark of this market, allowing fleet operators and businesses to personalize flooring materials with branding elements, logos, and unique designs. This customization not only enhances the visual appeal of commercial vehicles but also fosters a sense of identity and professionalism.

Technological integration is a rising trend, with smart flooring solutions equipped with sensors for cargo monitoring, temperature control, and vehicle diagnostics. These technological advancements enhance operational efficiency, provide real-time data for improved fleet management, and cater to the demands of a digitized commercial vehicle industry.

The Global Commercial Vehicle Flooring Market is expanding globally, driven by increased demand from regions experiencing economic growth, urbanization, and robust logistics activities. Manufacturers are actively seeking opportunities in emerging markets to meet the rising demands for high-quality and innovative flooring solutions.

Overall, the market’s resilience lies in its adaptability to the evolving needs and preferences of commercial vehicle operators and passengers, ensuring that flooring solutions align with regulatory standards, sustainability goals, customization demands, and technological advancements within the industry.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on “Commercial Vehicle Flooring Market.” @ https://www.techsciresearch.com/report/commercial-vehicle-flooring-market/19296.html

North America boasts a robust commercial vehicle flooring market, driven by the region’s thriving logistics and transportation sectors. The United States, in particular, is a significant contributor, with a high demand for durable and safety-compliant flooring materials. Regulatory standards play a crucial role, with a focus on safety features like slip resistance. The aftermarket segment is prominent, as fleet operators often upgrade their vehicles’ interiors. Sustainability initiatives are gaining traction, influencing the choice of eco-friendly materials.

Europe places a strong emphasis on both safety and sustainability in its commercial vehicle flooring market. Stringent regulations govern flooring materials, ensuring compliance with safety standards. Sustainability trends are reflected in the adoption of recyclable and eco-friendly materials, aligning with the region’s environmental consciousness. Customization options are valued, especially in the passenger transport sector, where branding and aesthetics are crucial.

The Asia-Pacific region is witnessing rapid growth in the commercial vehicle flooring market, driven by expanding economies, urbanization, and increased logistics activities. Demand is high for cost-effective and durable flooring solutions, particularly in countries like China and India.

Customization and branding are increasingly relevant, catering to diverse business needs. The aftermarket segment is flourishing as fleet operators seek to improve and personalize their vehicles.

Latin America presents a diverse market for commercial vehicle flooring. The region’s unique challenges and requirements influence flooring choices. Durability is essential, given the often challenging road conditions. Sustainability initiatives are emerging, driven by environmental concerns. Aftermarket sales are notable as businesses look to enhance their fleets with upgraded flooring materials.

The Middle East and Africa region exhibit growth potential in the commercial vehicle flooring market. Demand is primarily driven by the construction and logistics sectors. Durability and resistance to extreme weather conditions are critical factors influencing material choices. Customization is less prominent, but safety features remain essential. Sustainability trends are emerging, reflecting global environmental concerns. Each region’s commercial vehicle flooring market is shaped by a combination of regulatory standards, economic factors, cultural preferences, and environmental considerations. Manufacturers and suppliers adapt their offerings to meet the specific needs of each region, making regional insights essential for understanding the global market landscape.

Major companies operating in the Global Commercial Vehicle Flooring Market are:

- Auto Custom Carpet Inc

- Kotobukiya Fronte Co., Ltd.

- Hayakawa Eastern Rubber Co., Ltd.

- Lear Corporation

- Grupo Antolin Irausa, S.A.

- IAC Group

- Feltex Automotive

- IDEAL Automotive GmbH

- Hayashi Telempu

- Shanghai Shenda

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=19296

Customers can also request for 10% free customization on this report.

“The Global Commercial Vehicle Flooring Market emphasizes the industry’s commitment to safety, compliance, and sustainability. Experts highlight the significance of innovative materials that meet stringent regulatory standards while addressing environmental concerns. Customization and technological integration are seen as crucial for enhancing user experience and operational efficiency. Additionally, experts stress the market’s adaptability to regional variations and emerging markets, offering opportunities for growth and market expansion,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Global Commercial Vehicle Flooring Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028, Segmented By Vehicle Type (LCV, M&HCV), By Material (Polyurethane, Polypropylene, Nylon, Rubber, Others), By Sales Channel (OEM, Aftermarket ), By Region and By Competition Forecast & Opportunities, 2018-2028F”, has evaluated the future growth potential of Global Commercial Vehicle Flooring Market and provides statistics & information on market size, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Commercial Vehicle Flooring Market.

You may also read:

United States Electric Vehicle Market Revving Up to 750K Units in 2022, Set for Exponential Expansion

South America Ultra High-Performance (UHP) Tire Market Turbocharged Trends – Insights into a USD 530 Million Valuation in 2022

India Tractor Market Flourishing – USD 7.8B, 6.13% CAGR

Milestone Global Automotive Elastomers Market Hits USD 33 Billion in 2022

Automotive Interior Leather Market Luxe Drives to $53 Billion in 2022, Anticipates 5.48% CAGR through 2028

Table of Content-Commercial Vehicle Flooring Market

- Introduction

1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

- Research Methodology

2.1. Objective of theStudy

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

- Impact of COVID-19 on Global Commercial Vehicle Flooring Market

- Global Commercial Vehicle Flooring Market Outlook

5.1. Market Size & Forecast

5.1.1. By Volume & Value

5.2. Market Share & Forecast

5.2.1. By Vehicle Type Market Share Analysis (LCV, M&HCV)

5.2.2. By Material Market Share Analysis (Polyurethane, Polypropylene, Nylon, Rubber, Others)

5.2.3. By Sales Channel Market Share Analysis (OEM, Aftermarket)

5.2.4. By Regional Market Share Analysis

5.2.4.1. Asia-Pacific Market Share Analysis

5.2.4.2. Europe & CIS Market Share Analysis

5.2.4.3. North America Market Share Analysis

5.2.4.4. South America Market Share Analysis

5.2.4.5. Middle East & Africa Market Share Analysis

5.2.5. By Company Market Share Analysis (Top 5 Companies, Others – By Value, 2022)

5.3. Global Commercial Vehicle Flooring Market Mapping & Opportunity Assessment

5.3.1. By Vehicle Type Market Mapping & Opportunity Assessment

5.3.2. By Material Market Mapping & Opportunity Assessment

5.3.3. By Sales Channel Market Mapping & Opportunity Assessment

5.3.4. By Regional Market Mapping & Opportunity Assessment

- Asia-Pacific Commercial Vehicle Flooring Market Outlook

6.1. Market Size & Forecast

6.1.1. By Volume & Value

6.2. Market Share & Forecast

6.2.1. By Vehicle Type Market Share Analysis

6.2.2. By Material Market Share Analysis

6.2.3. By Sales Channel Market Share Analysis

6.2.4. By Country Market Share Analysis

6.2.4.1. China Market Share Analysis

6.2.4.2. India Market Share Analysis

6.2.4.3. Japan Market Share Analysis

6.2.4.4. Indonesia Market Share Analysis

6.2.4.5. Thailand Market Share Analysis

6.2.4.6. South Korea Market Share Analysis

6.2.4.7. Australia Market Share Analysis

6.2.4.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Commercial Vehicle Flooring Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Volume & Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Vehicle Type Market Share Analysis

6.3.1.2.2. By Material Market Share Analysis

6.3.1.2.3. By Sales Channel Market Share Analysis

6.3.2. India Commercial Vehicle Flooring Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Volume & Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Vehicle Type Market Share Analysis

6.3.2.2.2. By Material Market Share Analysis

6.3.2.2.3. By Sales Channel Market Share Analysis

6.3.3. Japan Commercial Vehicle Flooring Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Volume & Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Vehicle Type Market Share Analysis

6.3.3.2.2. By Material Market Share Analysis

6.3.3.2.3. By Sales Channel Market Share Analysis

6.3.4. Indonesia Commercial Vehicle Flooring Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Volume & Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Vehicle Type Market Share Analysis

6.3.4.2.2. By Material Market Share Analysis

6.3.4.2.3. By Sales Channel Market Share Analysis

6.3.5. Thailand Commercial Vehicle Flooring Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Volume & Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Vehicle Type Market Share Analysis

6.3.5.2.2. By Material Market Share Analysis

6.3.5.2.3. By Sales Channel Market Share Analysis